So each time you want to make a purchase, you can create a new virtual credit card to carry out the transaction. These features are put in place to help prevent fraudulent purchases without having to use your main credit card account.

What Is the Difference Between Virtual Credit Cards and Digital Wallets?

As well as improve the safety of your business. Armed with this information, you’ll be able to make educated decisions about how you can use this new type of payment. We’ll take a closer look at what virtual credit cards are and how they work. But what exactly are virtual credit cards? Many companies and people around the world are now making use of virtual credit cards as a way of reducing the risk of fraud. But as we’ve moved towards digital payments, the number of data breaches and instances of fraud have risen dramatically. The way that we pay for things has drastically changed over the years.Ĭash used to be king, then using either a credit card or a debit card took over before contactless payments became all the rage. Send invoices, track time, manage payments, and more…from anywhere.

Set clear expectations with clients and organize your plans for each projectĬlient management made easy, with client info all in one placeįreshBooks integrates with over 100 partners to help you simplify your workflows Organized and professional, helping you stand out and win new clients Track project status and collaborate with clients and team members Tax time and business health reports keep you informed and tax-time readyĪutomatically track your mileage and never miss a mileage deduction again Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours

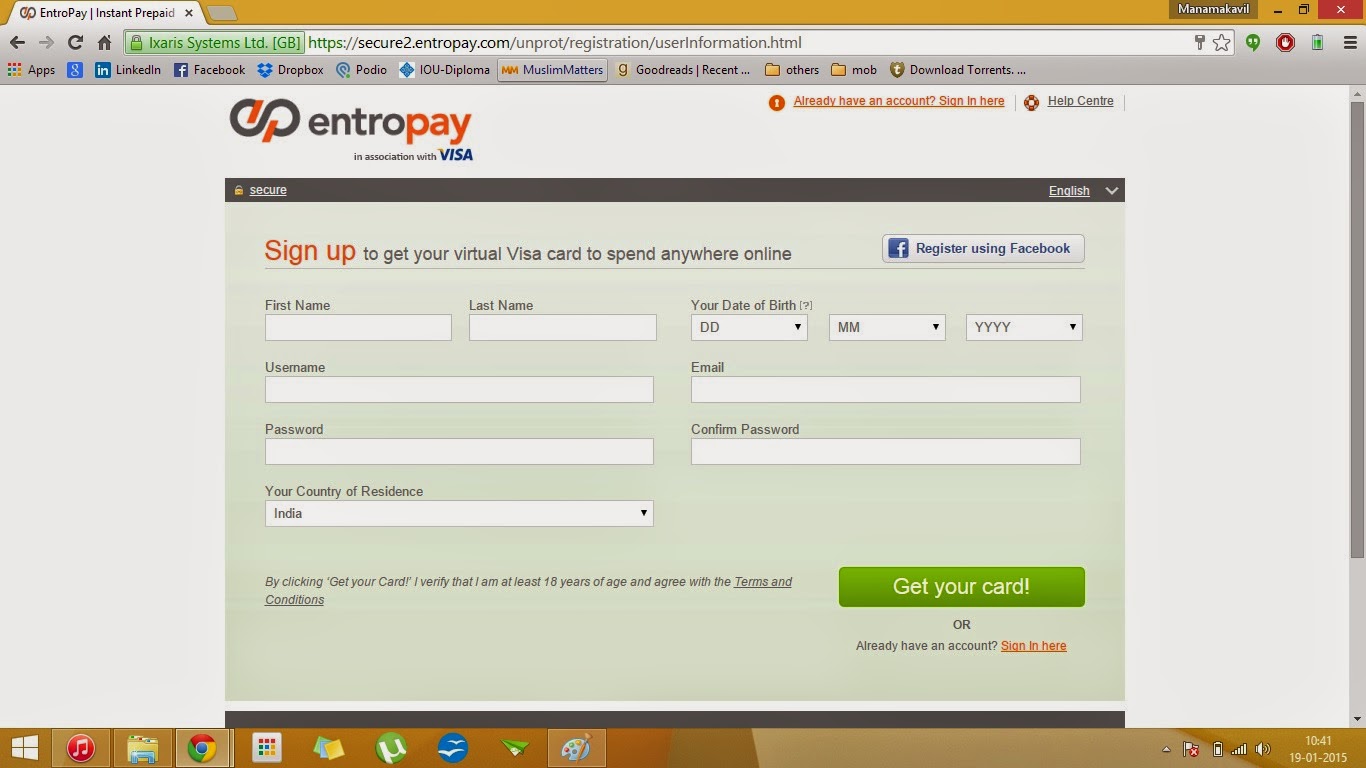

CREATE VIRTUAL CREDIT CARD PROFESSIONAL

Wow clients with professional invoices that take seconds to create

0 kommentar(er)

0 kommentar(er)